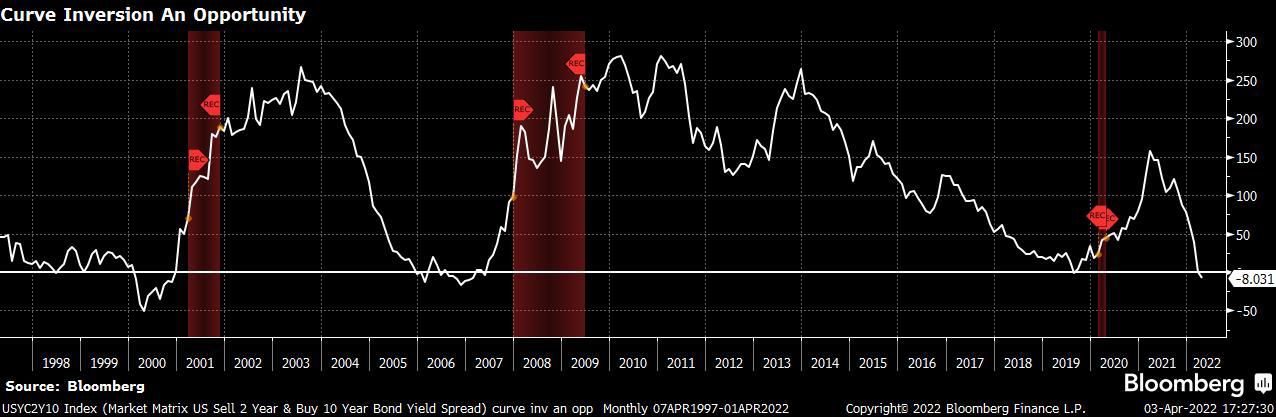

Recession indicator?

Last week, the 2-year and 10-year US Treasury yields inverted for the first time since 2019, re-igniting the topic of recession linked to yield curve inversion. This widely known recession indicator had forecasted about 85 percent of US recessions over the last 158 years when short-term interest rates moved higher than longer-term rates.

As of April 1, 2022, Two-year Treasury yields jumped to 2.45%, surpassing benchmark 10-year U.S. Treasury yields, which also rose to 2.37%. This is considered an irregularity, as investors typically demand a higher return for locking up money for a longer period.

Does the current yield curve inversion imply a coming recession?

Past recessions indicated by the yield curve inversion have their roots in tight Fed monetary policies, which eventually tipped the economy into a downturn. However, analysts are arguing that the case for recession is weak as the latest inversion is based on anticipated rate hikes and not actual Fed action. Almost everyone is expecting further rate hikes in the months ahead after the Fed’s first rate hike in mid-March (the first since December 2018), and with the Fed has signaling a possible further 6 rate hikes this year.

Furthermore, latest US employment data also suggests that recession is not the base case, with March employment data reported last Friday showing gains in labor-force participation with nonfarm payrolls continuing to grow robustly, up 431,000 last month after an upwardly revised 750,000 increase in February. (Source: Bloomberg, 2 Apr 22)

Closer to home, we are seeing the effects of anticipated rate hikes

The Singapore Government Bond Yield Curve (which shows the yield of Singapore Government bonds across different maturities), have reacted accordingly to investor expectations of rate hikes, translating into a rise in yields across all bond yield tenors with the most increase seen in 2 and 3 year tenures.

In fact, as of 31 Mar 2022, the yields on 2 year Singapore government bonds have risen to 1.9% from 0.9% - a jump of 1% - since the start of the year. The current yield is close to the record high of 2.1% last seen in November 2018

✅A window of opportunity has opened up for investors looking to allocate into short-term bonds

With the 2-year rates near their record highs, we can expect that yields on short duration bonds have risen, which strongly suggests that now will be a good time to invest in short duration bonds as they offer a much more attractive entry point for investors. The short tenor also means that interest rate risks will be significantly lower.

✅Investors can consider these short duration SGD bonds. - As of 1st April, we are still seeing sizes for these short duration bonds!

OLAMSP 5.500% Perpetual Corp (SGD) Ask Price: 100.60 (YTW: 3.244%)

OLAMSP 6.000% 25Oct2022 Corp (SGD) Ask Price: 101.80 (YTW: 2.698%)

ARTSP 3.880% Perpetual Corp (SGD) Ask Price: 99.30 (YTW: 4.180%)

AAREIT 3.600% 12Nov2024 Corp (SGD) Ask Price: 101.95 (YTW: 2.818%)

SOCGEN 6.125% Perpetual Corp (SGD) Ask Price: 102.50 (YTW: 4.817%)

WINGTA 4.080% Perpetual Corp (SGD) Ask Price: 99.26 (YTW: 5.07%) - Available on bond express

OHLSP 6.900% 08Jul2024 Corp (SGD) Ask Price: 99.08 (YTW: 7.48%)- Available on bond express

✅Our recommended short duration bond funds such as the Nikko AM Shenton Short Term Bond SGD, United SGD Fund Cl A Acc SGD and the LionGlobal Short Duration Bond Cl A Acc SGD have also declined by -1.43%, -1.86% and -2.26% respectively on a year-to-date basis (as of 31 Mar 2022) – which also provides an attractive entry point to for investors seeking to allocate to the fixed income portion or their portfolios.

Existing investors in any one of the short duration bond funds above do not need to fret as the mark-to-market decline doesn’t translate to a realisation off losses. While bond prices fluctuate over due to changing interest rates, bond maturity proceeds are fixed. As long as the bond doesn’t default, the bond principal will be returned at maturity. Thus investors should remain invested as the coupons collected along the bond’s lifespan combined with the return of principal will provide returns to the investor.